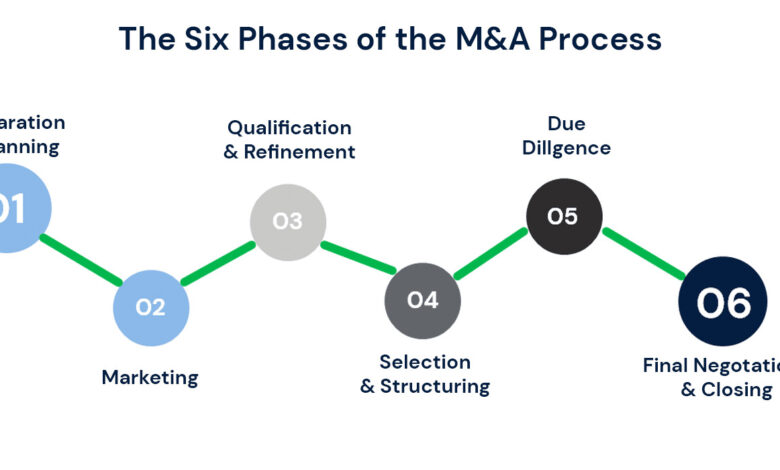

Key steps involved in the M&A process

Whether one is involved in investment banking, corporate development, or other financial transactions, there is a need to develop an M&A (mergers and acquisitions) deal process to follow. The investment bankers recommend their clients on various M&A steps in the procedure. The industrial m&a process consists of multiple steps that can take anywhere from six months to several years to complete.

Developing an acquisition strategies

Developing an acquisition strategy is one of the foremost steps that play a critical role. When a strategy is developed, it includes the acquirer having a clear idea of what is expected from making the acquisition. The strategy clearly defines the motive of the business and the reason behind acquiring the target company. Additionally, the acquisition strategy must include whether the business has the motive to gain access to new markets, or expand its product lines.

Setting M&A search criteria and searching potential targets

The next step involves determining the vital factors for recognizing the potential target companies. The customer base, profit margins, and geographical location determine the search criteria of the M&A process. Furthermore, the acquirer makes use of the recognized search criteria to look out for. This helps to assess the potential target companies for the M&A process.

Start acquisition planning

The acquisition planning begins when the acquirer contacts one or more companies that cater to the industrial m&a search criteria and thereby consider offering good value. The prime intention of the initial communication is to acquire as much information as possible. This allows one to find out the compatibility of the target company with merger and acquisition. Once the acquisition planning is complete, the valuation analysis is performed.

Performing valuation analysis

Once the initial communication and interaction are successful, the acquirer asks the target company to offer relevant information, especially related to the present financial figures. This allows the acquirer to assess more about the target company, as a business, and as a suitable acquisition or merger target. This is the stage where the M&A company finally decides to approach the target company and acquire it realizing and evaluating all the pros and cons.

Negotiations and due diligence

After considering multiple valuation models of the target company, the acquirer receives adequate information to develop a reasonable offer. Once the initial offer is presented and considered, the two companies (the target company and the acquirer) can negotiate terms and conditions in detail. This is followed by due diligence, which begins once the target company accepts the offers. Due diligence helps the acquirer to assess the value of the target company via a detailed evaluation of the target company’s operations based on human resources, financial factors, assets and liabilities, customers, and so on. Finally, there is a purchase and sale contract which is followed by the closing of the M&A process.

Conclusion

The above-mentioned are some of the vital steps that must be followed when there is an industrial m&a. The merger and acquisition process includes all the steps that are included in merging and acquiring a target company from the start till the finish.